Reverse Takeovers of Hong Kong Listed Companies

BACKDOOR LISTING IN HONG KONG

1. RTOs vs IPOs

Historically, reverse takeovers (RTOs) were used as an alternative means of achieving a stock exchange listing. In a typical reverse takeover, a company (the Acquiree) would identify a target HKEx-listed company. The listed company would then acquire the shares in the Acquiree or another company, or other assets of the Acquiree, and issue shares (ordinary or preference shares) and/or convertible bonds in consideration, giving the Acquiree a controlling stake in the listed company.

The main advantages of using a reverse takeover to list were:

- no significant regulatory review was required and there was no prospectus requirement;

- the timeframe for completion of an RTO was considerably shorter than that for an IPO;

- RTOs are not subject to the vagaries of the market;

- the new owners of the listed company would generally suffer less share dilution and thus have greater control; and

- costs could also be saved due to the lack of an underwriter and listing sponsor.

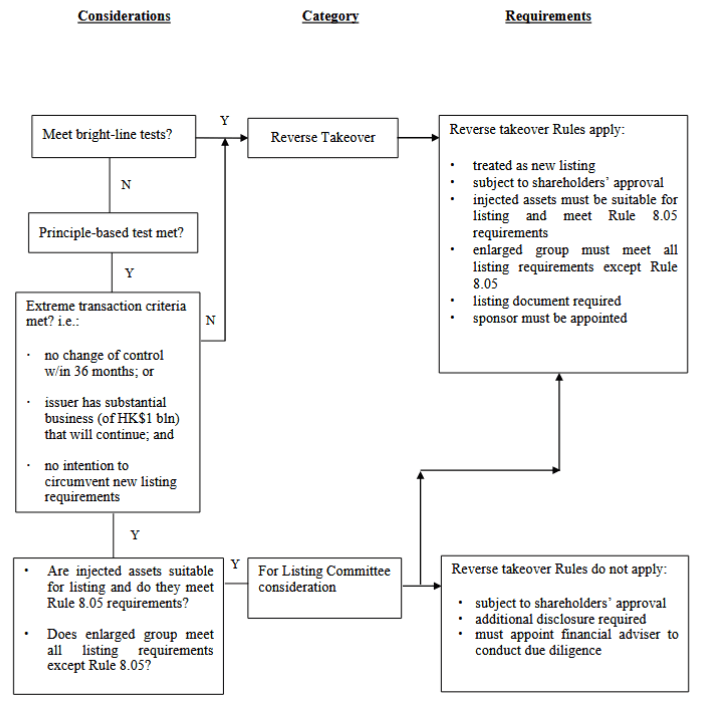

2. Hong Kong Regulatory Status of Reverse Takeovers

The Hong Kong Stock Exchange (HKEx) and the Securities and Futures Commission (the SFC), regard reverse takeovers as attempts to list in circumvention of the HKEx’s listing requirements, which include financial eligibility criteria and requirements that the applicant and its business are suitable for listing and that there is sufficient public interest in the listing applicant’s shares. In bypassing HKEx’s requirements for listing applicants, reverse takeovers also avoid the disclosure requirements, due diligence process and regulatory vetting procedures for new listings. The HKEx’s Listing Rules thus treat reverse takeovers as new listings subject to all the requirements for new listings. Where, however, an issuer can demonstrate that the transaction(s) in question are not seeking to list the acquisition targets in circumvention of the HKEx Listing Rules’ requirements, and there has been no change of control or the issuer has a substantial business which will continue after the transaction, the HKEx will treat the transaction as an extreme transaction rather than a new listing. While not subject to the new listing requirements, the acquisition targets the subject of an extreme transaction must meet the Listing Rules’ financial and suitability requirements and the listed issuer must publish a shareholders’ circular and appoint a financial adviser to conduct due diligence on the acquisition targets.

The Listing Rules define “acquisition targets” as the assets to be acquired, or where there is a series of transactions and/or arrangements, the assets acquired and/or to be acquired (Main Board Listing Rule 14.04(2A) and GEM Listing Rule 19.04(2A)). Accordingly, a series of transactions and/or arrangements can include a completed acquisition(s).

In the 2110s, concerns relating to share price volatility of shell companies which the HKEx and SFC regard as vehicles for reverse takeovers, led to increasingly stringent regulation of reverse takeovers. To deal with these concerns, the HKEx tightened the Listing Rules and issued HKEx Guidance Letter 104-19[1] (GL104-19) on 1 October 2019.

The HKEx identifies potential reverse takeovers through: (i) post-vetting announcements for transactions below the very substantial acquisition threshold; (ii) vetting draft announcements for very substantial acquisitions; and (iii) handling enquiries relating to potential reverse takeovers.

3. Reverse Takeovers Defined

3.1 Bright Line Tests for Reverse Takeovers

The Listing Rules set out bright line tests for two specific types of reverse takeovers:

- an acquisition or a series of acquisitions of assets (aggregated under Main Board Rules 14.22 and 14.23/ GEM Rules 19.22 and 19.23) by a listed issuer which constitute a very substantial acquisition (VSA) where there is, or which will result in, a change of control (as defined in the Takeovers Code (currently 30%)) of the listed issuer (other than at the level of its subsidiaries); and

- an acquisition or acquisitions of assets by a listed issuer which constitute a very substantial acquisition from a person or group of persons under any agreement or arrangement entered into by the listed issuer within 36 months of that person or group of persons gaining control of the listed issuer, other than at the level of its subsidiaries, where the original acquisition of control was not regarded as a reverse takeover (Note 2 to Main Board Rule 14.06B and GEM Listing Rule 19.06B).

Under the bright line tests, acquisitions in the 36 months after a change in control, which individually or together cross the threshold of a VSA, will constitute a reverse takeover and be treated as a new listing.

3.2 The Principle-based Test for Reverse Takeovers

A transaction falling outside the bright line tests, for example a transaction where there is no change of control, may still constitute a reverse takeover under the HKEx Listing Rules’ principle-based test which gives the HKEx broad discretion to classify a transaction as a reverse takeover. The HKEx will apply the principle-based test to determine whether an acquisition (either alone, or with other transactions or arrangements), attempts to list the acquisition targets in circumvention of the requirements for new listings.

The principle-based test defines a reverse takeover as an acquisition or a series of acquisitions of assets by a listed issuer which, in the opinion of the HKEx, constitutes, or is part of a transaction and/or arrangement or series of transactions and/or arrangements, which constitute:

- an attempt to achieve a listing of the acquisition targets; and

- a means to circumvent the requirements for new listing applicants set out in Chapter 8 of the Main Board Listing Rules (GEM Chapter 11) (Main Board Listing Rule 14.06B and GEM Listing Rule 19.06B).

Applying the Principle-based Test

HKEx assesses six factors in determining whether the principle-based test applies to a transaction(s) (Note 1 to Main Board Listing Rule 14.06B (GEM Listing Rule 19.06B)). Guidance on how HKEx assesses these factors is set out in GL104-19.

1. Size of Acquisition relative to the Issuer

An acquisition of a “significant size” that renders the issuer’s existing business immaterial is likely to be regarded as an attempt to list a new business. There is no prescribed threshold for determining whether an acquisition is significant. In assessing the acquisition’s impact on the issuer, the HKEx takes into account the nature and scale of the issuer’s existing business after the acquisition, and whether the acquisition will cause a fundamental change to the issuer’s business.

2. Acquisition(s) Leading to a Fundamental Change in the Issuer’s Principal Business

Where an issuer acquires a target business that is completely different to its existing principal business, and the target business is substantially larger than its existing business, this may be regarded as a fundamental change in the issuer’s business. This is more likely to be the case where after the acquisition, the issuer is mainly conducting the target’s business and the business conducted prior to the acquisition is immaterial.

A “fundamental change in the issuer’s principal business” will not however arise in relation to acquisitions that are part of the issuer’s business strategies relating to its existing business, including business expansion or diversification, or are consistent with the issuer’s size and resources. This could include an issuer expanding upstream or downstream into new business segments or its acquisition of businesses as part of an expansion strategy. Examples given in GL104-19 of acquisitions that would not involve a fundamental change in business are:

- technology companies acquiring businesses in mature industries as part of their business strategies, where the acquisitions are part of their expansion strategies; and

- a financial service company’s acquisition of app-based retail banking services business as part of a strategy to expand into fintech.

Where an issuer with a mature business acquires a target business that is completely different from its existing business to diversify, this will not normally be regarded as a reverse takeover if there is no change in control or de facto control and the acquisition size is not significant compared to the issuer.

3. The Nature and Scale of the Listed Issuer’s Business before the Acquisition(s)

The HKEx is particularly concerned about shell activities. Significant acquisitions by listed issuers with “shell” like characteristics are more likely to be reverse takeovers. For example, an issuer that has wound down/disposed of its original business and moved into new businesses that can be easily discontinued (e.g. trading business or money lending business) may suggest that the issuer is engaged in shell activities to facilitate backdoor listing. A newly listed issuer that conducts a series of arrangements (such as change in controlling shareholder, acquisitions and/or disposals) shortly after expiry of the lock-up period may also be an indication of shell activities.

4. The Quality of the Acquisition Targets

The HKEx will consider whether the target business can meet the eligibility and suitability criteria for new listing. In general, a substantial acquisition of a target business that is not suitable for listing is likely to be considered to circumvent the new listing requirements, as that target business would not otherwise obtain a new listing. Examples include early exploration companies or a business that operates illegally. Similarly, acquisitions of new businesses or assets that have no track record or have yet to commence operations are more likely to raise questions. This is particularly so where the target business is completely different from that of the issuer.

5. Change in Control or de facto Control of the Listed Issuer

Acquisitions that are not a reverse takeover under the bright line tests may be regarded as a reverse takeover under the principle-based test. In determining whether there has been a change in control or de facto control, the HKEx takes into account:

- any change in the listed issuer’s controlling shareholder; or

- any change in its single largest substantial shareholder who is able to exercise effective control over the listed issuer, as indicated by factors such as a substantial change to its board of directors and/or senior management.

These are non-exhaustive factors. There will not normally be considered to be a change in control or de facto control where a new substantial (and not controlling) shareholder is a passive investor. Where there are changes to the issuer’s board of directors and/or senior management, there will not normally be a change of control if there is no change in the issuer’s controlling or single largest substantial shareholder. However, if the issuer does not have a controlling shareholder or single largest substantial shareholder, substantial change to the board/ senior management may give rise to questions as to whether there is a change in de facto control of the issuer.

The HKEx generally applies this factor together with the “series of transactions and/or arrangements” factor. By way of example, an investor acquires a material shareholding in an issuer and appoints new directors to the issuer’s board who have no experience in the issuer’s original business, but have experience in businesses subsequently acquired by the issuer. The HKEx may apply the reverse takeover rules if, taking into account all relevant factors, it considers that these actions are a means to achieve a listing of the new business and to circumvent the requirements for new listings. According to the HKEx, a change in control of a listed issuer together with a series of transactions involving disposals of its existing business and acquisitions of new businesses commonly signals that the new investors are seeking to list the new businesses in circumvention of the new listing requirements.

Change in de facto control resulting from the issue of restricted convertible securities

Where an issuer issues restricted convertible securities (i.e. convertible securities with a conversion restriction mechanism which avoids triggering a change of control under the Takeovers Code) in consideration for an acquisition of assets, the HKEx will assess whether the issue will allow the vendor (as holder of the convertible securities) to effectively “control” the issuer. This would be the case where the vendor would become the issuer’s controlling shareholder if the convertible securities were fully converted and where:

- the issuer does not have a controlling shareholder at the time it proposes the acquisition; or

- the existing controlling shareholder would cease to be a controlling shareholder after the conversion (GL104-19 at paragraph 25).

6. Events and Transactions which together with the Acquisition form a Series of Transactions and/or Arrangements to Circumvent the New Listing Requirements

A series of transactions or arrangements over a period of time which seek to circumvent the requirements for new listings will be caught as a reverse takeover subject to the new listing requirements. Examples include:

- a series of smaller transactions that result in the listing of a new business; and

- re-sequencing transactions to acquire a new business before disposing of the issuer’s existing business; and

- a series of acquisitions and disposals.

A series of transactions or arrangements is treated as one transaction in determining whether the reverse listing rules apply. The “series of transactions and/or arrangements” factor is normally applied in conjunction with other assessment factors such as the relative size of the transactions to the issuer, and whether the series of transactions and/or arrangements would lead to a fundamental change in the issuer’s principal business.

A series of transactions within 36 months or which are otherwise related

The HKEx may regard transactions and arrangements as a series if they take place in reasonable proximity to each other (i.e. normally within a period of 36 months) or are otherwise related. Transactions and arrangements can include change in control or de facto control, and acquisitions or disposals of businesses. Consequently, a disposal may trigger a reverse takeover ruling with respect to a previously completed acquisition in the same series, or a number of smaller acquisitions may form a reverse takeover. The reverse takeover rules may therefore be triggered where a listed company disposes of its original business following an acquisition of a new business.

A transaction or arrangement falling outside the 36-month period will not normally be regarded as part of a series unless there is a clear nexus between the transactions and/or arrangements or there are other specific concerns suggesting an attempt to circumvent the reverse takeover rules. Examples of these circumstances would be:

- where an issuer acquired a new business with an option to acquire another target business and the option is exercised more than three years after the original acquisition;

- where a transaction proposed just outside the 36-month period was under contemplation during the 36-month period; and

- where an issuer terminated or downsized a proposed acquisition of a new business in response to a ruling by the HKEx that it constituted a reverse takeover, the HKEx may treat any further acquisition(s) of the new business made outside the 36-month period as part of a series.

Guidance on aggregation of transactions

Where an issuer acquires new business(es) over a period, the HKEx may aggregate the acquisitions in determining whether the acquired businesses together are substantial to the issuer and an attempt to list the acquired businesses. Acquisitions that will be considered to be part of a series will normally bear some relationship to each other, such as: (a) acquisitions that are part of a similar line of business; or (b) acquisitions of interests in the same company or group of companies in stages; or (c) acquisitions of businesses from the same or a related party.

In determining whether the size of the acquisitions in a series is substantial, the HKEx will normally compare the aggregated financial figures/ consideration for the acquisition targets to the size of the issuer, being the lower of:

- the issuer’s latest published financial figures (revenue, profits and assets) or market capitalisation before the first transaction in the series; and

- its latest published financial figures or market capitalisation at the time of the last transaction in the series.

Where an issuer disposes of the business it operated at the commencement of the series of transactions (the original business), this will reduce the size of the issuer. This may affect HKEx’s assessment of other assessment factors, including whether there is a fundamental change in the issuer’s business, which may in turn affect the determination of whether the size of the acquisitions is substantial, and whether the issuer is a “shell”.

3.3 Restriction on Disposals after a Change in Control

A listed issuer is prohibited from carrying out a disposal or distribution in specie (or a series of disposals and/or distributions in specie) of all or a material part of its existing business:

- where there is a proposed change in control of the listed issuer (other than at the level of its subsidiaries); or

- within 36 months after a change in control,

unless the remaining group, or the assets acquired from the person or group of persons gaining control or their associates and any other assets acquired by the listed issuer after the change in control, can meet the requirements of Main Board Rule 8.05 (or Rule 8.05A or 8.05B)/GEM Rule 11.12A or 11.14) (Main Board Listing Rule 14.06E (GEM Listing Rule 19.06E). If this is not the case, the transaction will be treated as a new listing.

In determining whether to apply this rule, the HKEx will consider whether the disposal(s) and/or distribution(s) in specie form part of a series of arrangements to circumvent the new listing requirements.

These Listing Rules may pose a problem in cases where an outgoing shareholder is reluctant to sell the listed vehicle without retaining certain assets.

3.4 Backdoor Listing on HKEx through Large Scale Issue of Securities

Main Board Listing Rule 14.06D (GEM Listing Rule 19.06D) seeks to prevent an investor acquiring control or de facto control of a listed issuer through a large scale subscription of the issuer’s securities (including shares, warrants, options or convertible securities) for cash where the listed issuer will use the proceeds to acquire and/or develop a new business that is expected to be substantially larger than the listed issuer’s existing business. The HKEx can refuse to grant listing approval for the shares to be issued if it considers that the purpose of these arrangements is to list the new business in circumvention of the requirements for new listing applicants.

The HKEx has issued Guidance Letter GL105-19 (GL105-19) on the application of this Listing Rule which notes that the Listing Rule is aimed at large scale fundraisings which enable investors to acquire control of a listed issuer in order to list a new business that would not have met the requirements for new listing since the new business lacks the track record required for a new listing. According to GL105-19, an equity fundraising with the following characteristics will normally be caught by Listing Rule 14.06D (GEM Listing Rule 19.06D):

- the fundraising’s size is very significant to the issuer and has little or no correlation to the needs of the issuer’s existing principal business;

- the funds will be used mainly to develop and/or acquire a new business with little or no relation to the issuer’s existing principal business. This would include where a listed issuer starts the new business shortly before the planned fundraising;

- the issuer uses the cash raised in the fundraising to operate a new business which is expected to be substantially larger than its original business; and

- the investor gains control or de facto control of the issuer by subscribing for its securities enabling the investor to list the new business. This circumvents the new listing requirements since the new business lacks the track record required for listing.

Listing Rule 14.06D (GEM Listing Rule 19.06D) is not intended to prevent issuers raising funds for legitimate business expansions or diversifications. It will not normally apply to a securities issue if, taking into account the funds raised by the securities issue, less than half of the issuer’s assets would consist of cash after the fundraising. It is not, however, simply a question of analysing the issuer’s cash to asset ratio. The HKEx acknowledges in GL105-19 that issuers operating asset-light businesses (such as tech companies) may have a cash to asset ratio exceeding 50% after raising funds. In these cases, the HKEx will consider all relevant factors in determining whether an issuer’s proposed equity fundraising activities are seeking to circumvent the new listing requirements.

The HKEx can also apply the principle based test under Listing Rule 14.06B when an issuer uses the proceeds of a fundraising to acquire a new business. It might do so in the case of a fundraising to which Listing Rule 14.06D does not apply, for example where there was no change of control, but the subsequent acquisition using the raised funds is an attempt to circumvent the new listing requirements under the principle based test.

The HKEx encourages listed issuers who intend to undertake large equity fundraisings to contact it for guidance on the application of Listing Rule 14.06D.

4. Consequences of Classification as a Reverse Takeover

4.1 Consequences of Reverse Takeover Classification

Where the HKEx rules that a transaction or series of transactions constitutes a reverse takeover, it will treat the listed issuer concerned as a new listing applicant. The listed issuer will need to provide to the HKEx sufficient information to show that the acquired assets:

- are suitable for listing (under Main Board Listing Rule 8.04 or GEM Listing Rule 11.06); and

- can meet the financial and track record requirements of Main Board Listing Rule 8.05 (or 8.05A or 8.05B) or GEM Listing Rules 11.12A or 11.14 (Main Board Listing Rule 14.54(1) GEM Listing Rule 19.54(1).

In addition, the enlarged group must meet all the new listing requirements set out in Chapter 8 of the Listing Rules (except Main Board Listing Rule 8.05) or GEM Chapter 11 (except GEM Rule 11.12A). The track record period for the acquired assets normally covers the three financial years (for Main Board issuers) or two financial years (for GEM issuers) prior to the issue of the listing document for the latest proposed transaction of the series.

Main Board Listing Rule 14.54(2) (GEM Listing Rule 19.54(2)) further requires that where a listed issuer proposing a reverse takeover has failed to comply with Main Board Listing Rule 13.24 (GEM Listing Rule 17.26) (on sufficiency of operations and assets), the acquisition targets must also meet the requirement of Main Board Listing Rule 8.07 (GEM Listing Rule 11.22A). This requires that the listed issuer and its sponsor demonstrate that there is sufficient public interest in the business of the acquisition target and the enlarged group. This can be demonstrated by, for example, conducting a public offer or other analysis with evidence showing sufficient public interest in the acquisition targets.

Note 1 to Main Board Listing Rule 14.54 (GEM Listing Rule 19.54) states that if the HKEx is aware of information that suggests that a reverse takeover is being conducted to avoid any new listing requirement, the listed issuer will have to demonstrate that the acquisition targets meet all the new listing requirements set out in Chapter 8 of the Main Board Listing Rules (or Chapter 11 of the GEM Listing Rules).

4.2 Waivers

The HKEx may grant a waiver from strict compliance where a reverse takeover involves a series of transactions and/or arrangements and the acquired assets cannot meet the management continuity and/or the ownership continuity and control requirements of Main Board Rule 8.05(1)(b) and/or (c) (GEM Listing Rule 11.12A(2) and/or (3)) due to a change in their ownership and management solely as a result of their acquisition by the listed issuer. In considering whether to grant a waiver, the HKEx will consider whether the listed issuer has the expertise and experience in the relevant business/industry of the acquired assets to ensure their effective management and operation (Note 3 to Main Board Listing Rule 14.54/ GEM Listing Rule 19.54).

4.3 Reverse Takeover Announcement

Main Board Listing Rule 14.54(3) (GEM Listing Rule 19.54(3)) requires a listed issuer to publish an announcement as soon as possible after the reverse takeover’s terms are finalised which must include the identity and a description of the principal business activities of the counterparty to the transaction. The announcement must be pre-vetted by the HKEx before publication.[2] A listed issuer must also comply with the requirements of Main Board Listing Rule 14.36B (GEM Listing Rule 19.36B) if it will acquire a company or business from a person(s) who guarantees the profits, assets or other aspects of the financial performance of the company or business. Prior to the publication of the announcement, the listed issuer must ensure that the information remains confidential. If it cannot ensure the required degree of security or suspects that security may have been breached, it should publish an announcement immediately or apply to the HKEx for a trading halt or trading suspension until the announcement is published. On a reverse takeover, dealing in the issuer’s securities must be suspended until sufficient information has been announced (Main Board Listing Rule 14.37(3) and (5) / GEM Listing Rule 19.37(3) and (5)).

4.4 Shareholders’ Approval of Reverse Takeover

A reverse takeover must be made conditional on approval by shareholders in general meeting. Written shareholders’ approval will not be accepted in lieu of holding a general meeting. The listing document must be sent to shareholders at the same time as, or before, the listed issuer gives notice of the general meeting to approve the transaction.

Where a reverse takeover involves a series of transactions, the shareholders’ approval requirement applies only to the proposed transaction (i.e. the last in the series of transactions).

Any shareholder with a material interest in the transaction and their close associates must abstain from voting on the resolution(s) to approve the transaction in general meeting. If there is a change in control of the listed issuer and any person or group of persons will cease to be a controlling shareholder (the outgoing controlling shareholder) as a result of disposing of their shares to the person or group of persons gaining control (the incoming controlling shareholder), the following persons are prohibited from voting in favour of any resolution approving an injection of assets by the incoming controlling shareholder or his close associates at the time of the change in control:

- any of the incoming controlling shareholder’s close associates; and

- the outgoing controlling shareholder and their close associates.

The prohibition against the outgoing controlling shareholder and their close associates voting in favour of a resolution approving an injection of assets does not apply where the decrease in the outgoing controlling shareholder’s shareholding is solely the result of a dilution through the issue of new shares to the incoming controlling shareholder, rather than any disposal of shares by the outgoing controlling shareholder.

4.5 Reverse Takeover Listing Document

The listed issuer must comply with the procedures and requirements for new listing applicants set out in Chapter 9 of the Main Board Rules (Chapter 12 of the GEM Rules) and must issue a listing document and pay the initial listing fee. The listing document must contain the information required under Main Board Listing Rules 14.63 and 14.69 (GEM Listing Rules 19.63 and 19.69) including:

- certain information required for a new listing applicant under Appendix D1A to the Listing Rules;

- information on the enlarged group’s property interests under Main Board Listing Rules 5.01A and 5.01B (GEM Listing Rules 8.01A and 8.01B).

The listing document must be sent to the listed issuer’s shareholders together with a notice convening the meeting at which the reverse takeover will be voted on by shareholders.

The listed issuer must also appoint a sponsor which will need to conduct full due diligence and the new listing will need to be approved by the HKEx.

5. Extreme Transactions

5.1 Extreme Transaction Definition

An “extreme transaction” is an acquisition or series of acquisitions of assets by a listed issuer which, individually or together with other transactions (which may include a disposal) or arrangements achieve a listing of the acquisition targets, where the listed issuer can demonstrate that this does not constitute an attempt to circumvent the requirements for a new listing (Main Board Listing Rule 14.06C/ GEM Listing Rule 19.06C). It is thus a reverse takeover where there is no intent to circumvent the Listing Rules’ new listing requirements. The extreme transaction classification is not available if a listed issuer has “shell” like characteristics.

To qualify as an “extreme transaction”, the following three conditions must also be met:

either:

- the listed issuer (other than at the level of its subsidiaries) has been under the control or de facto control of a person or group of persons for a long period (normally at least 36 months) before the proposed transaction, and the transaction would not result in a change in control or de facto control of the listed issuer. In making this assessment, the HKEx takes into account the factors referenced for “change in control or de facto control” under the principle based test set out in Note 1(e) to Listing Rule 14.06(B) (GEM Listing Rule 19.06(B)); or

- the listed company has been operating a principal business of a substantial size, which will continue after the transaction. HKEx Guidance Letter GL104-19 provides guidance on what constitutes a business “of a substantial size”, which includes a listed company with annual revenue or total asset value of HK$1 billion according to its latest published financial statements. The HKEx will also take into account the listed company’s financial position, the nature and operating model of its business and its future business plans;

the acquisition targets must:

- be suitable for listing under Main Board Listing Rule 8.04 (GEM Listing Rule 11.06); and

- meet the financial and track record requirements of Main Board Listing Rule 8.05, 8.05A or 8.05B (GEM Listing Rule 11.12A or 11.14); and

- the enlarged group must meet all the new listing requirements of Chapter 8 of the Main Board Listing Rules (except Listing Rule 8.05) or Chapter 11 of the GEM Listing Rules (except GEM Listing Rule 11.12A).

Track Record Period

The track record period for an extreme transaction involving a series of transactions and/or arrangements is three years (for Main Board listed companies) and two years (for GEM listed companies) before the issue of the circular for the latest proposed transaction in the series (Main Board Listing Rule 14.57A (GEM Listing Rule 19.57A)).

Where an extreme transaction involves a series of transactions or arrangements and the acquisition targets cannot meet the management continuity and ownership continuity and control requirements under Main Board Listing Rules 8.05(1)(b) and/or (c) or 8.05(2)(b) and/or (c) (GEM Listing Rules 11.12(A)(2) and/or (3) or 11.12A(4)(b) or (c)) due to a change in their ownership and management resulting solely from their acquisition by the listed issuer, the HKEx may grant a waiver from strict compliance with these Listing Rules. In considering whether to grant a waiver of these Listing Rules, the HKEx will consider, among others, whether the issuer has the expertise and experience in the relevant business/industry of the acquisition targets to ensure their effective management and operation.

5.2 Consequences of Classification as an Extreme Transaction

An extreme transaction is not treated as a new listing. However, a listed issuer proposing an extreme transaction is required to:

- comply with the requirements for very substantial acquisitions set out in Main Board Listing Rules 14.48 to 14.53 (GEM Listing Rules 19.48 to 19.53);

- publish an announcement as soon as possible after the terms of the extreme transaction have been finalised. The announcement must be pre-vetted by the HKEx and include the identity and a description of the principal business activities of the counterparty to the transaction;

- provide sufficient information to the HKEx to demonstrate that the acquisition target(s) meet Main Board Listing Rules 8.04 and 8.05 (or 8.05A or 8.05B) or GEM Listing Rule 12A or 11.14. This can be in the form of a draft circular with material information including, for example, a draft accountants’ report of the acquisition target for the track record period, a detailed description of its business and its management, risk factors, legal compliance and any other information as requested by the HKEx;

- issue a circular containing the information required under Main Board Listing Rules 14.63 and 14.69 (GEM Listing Rule 19.69) including:

- certain information required by Appendix D1A to the Listing Rules, to the extent applicable; and

- the information required under Main Board Chapter 5 (GEM Chapter 8) on the property interests acquired and/or to be acquired by the listed issuer;

- appoint a financial adviser to perform due diligence on the acquisition targets so that it is able to perform its obligations under Appendix E2 – “Financial Adviser’s Obligations for Extreme Transaction” (Main Board Listing Rule 14.53A (GEM Listing Rule 19.53A); and

- call a shareholders’ meeting to approve the extreme transaction. Shareholders’ approval by written resolution is not acceptable.

5.3 Extreme Transaction Announcement

Under Rule 13.52(2)(a) (GEM Rule 17.53(2)(a)), an announcement of an extreme transaction is subject to pre-vetting by the HKEx. The announcement must contain all pertinent information about the transaction, including the matters listed in Main Board Listing Rules 14.58 and 14.60 (GEM Listing Rules 19.58 and 19.60).

5.4 Shareholders’ Approval of an Extreme Transaction

An extreme transaction must be approved by the listed issuer’s shareholders in general meeting and the listing document or circular must be sent to shareholders at the same time as, or before, the listed issuer gives notice of the general meeting to approve the transaction. The announcement must state the expected date of despatch of the listing document or circular and, if this is more than 15 business days after the publication of the announcement, reasons must be given.

Where an extreme transaction involves a series of transactions, the shareholders’ approval requirement applies only to the proposed transaction (i.e. the last in the series of transactions).[3]

At a general meeting to approve an extreme transaction, any shareholder and his associates are barred from voting if the shareholder has a “material interest” in the transaction.

6. Hong Kong Takeovers Code Issues relevant to Reverse Takeovers and Extreme Transactions

6.1 Mandatory Offer Obligation and Whitewash Waivers

An offer to acquire 30% or more of the voting rights of a Hong Kong listed company will trigger the obligation under Rule 26 of the Takeovers Code to make a general offer to all shareholders of the target company on the same terms in the absence of a waiver from the SFC Executive.

Application may be made for a whitewash waiver from the obligation to make a general offer and this may be granted by the SFC Executive if the whitewash waiver is approved by 75% of the issuer’s independent shareholders and the reverse takeover is approved by 50% of independent shareholders. Independent shareholders mean shareholders who are not interested or involved in the transaction (Note 1 to Rule 26).

Rule 25 further prohibits an offeror and its associates from offering favourable conditions to one or more shareholders which are not available to all the other shareholders.

7. Implications of a Reverse Takeover of Mineral or Petroleum Assets

Chapter 18 of the Main Board Listing Rules and Chapter 18A of the GEM Listing Rules impose specific requirements for new applicant mining and petroleum companies in addition to the basic requirements for listing contained in Chapters 8 and 11 of the Main Board Rules and GEM Rules, respectively.

Chapter 18 (GEM Chapter 18A) applies to a Mineral Company which is defined as “a new applicant whose Major Activity (whether directly or through its subsidiaries) is the exploration for and/or extraction of Natural Resources, or a listed issuer that completes a Relevant Notifiable Transaction involving the acquisition of Mineral or Petroleum Assets”.

The term “Major Activity” is an activity of an issuer and/or its subsidiaries which represents 25% or more of the total assets, revenue or operating expenses of the issuer and its subsidiaries. When assessing whether or not this threshold has been reached, reference should be made to the issuer’s latest audited consolidated financial statements.

Listed issuers engaged in the resources sector when the regime for listing Mineral Companies came into effect were not automatically treated as Mineral Companies. However, any listed issuer will become a Mineral Company once it completes a Major Transaction, Very Substantial Acquisition or Reverse Takeover involving the acquisition of Mineral or Petroleum Assets.

Thus, a listed issuer which engages in a reverse takeover of a company involved in the resources sector will be treated as a Mineral Company. In addition to adhering to the basic conditions for listing, as set out in Chapter 8 of the Main Board Rules or Chapter 11 of the GEM Rules, if treated as a new applicant under the reverse takeover rules, the listed issuer must also satisfy the additional eligibility requirements for mineral and petroleum companies.

8. Restructuring Listed Companies

One path for rescuing a distressed listed company is to inject assets which meet the HKEx Listing Rules’ requirements for listing. This is acceptable to the HKEx as the issuer is subject to the full requirements of the Listing Rules and must follow the process for a new listing. Transactions in the 36 months after the restructuring may be subject to HKEx’s notifiable transactions requirements, but will not need to be aggregated with the original reverse takeover transaction which has already triggered the new listing requirements.

The downside for bank creditors leading a restructuring is that the pool of investors with assets meeting the listing requirements, and who are willing to invest in this type of restructuring, is likely to be small. As the investor is bringing his own assets, the likelihood is that he will be in a strong position to negotiate down the price for the listed company. Creditor banks who take an equity position in the restructuring may benefit in the long term given the injection of new assets. In the short-term, however, commentators have remarked that the immediate cash payout is likely to be substantially less than on a cash subscription type restructuring.

8.1 Cash Subscriptions and Business Resuscitations: Main Board Listing Rule 13.24/GEM 17.26

Cash injections as a route to corporate rescues run into problems under Main Board Listing Rule 13.24 (GEM 17.26).

These Rules provide that:

“An issuer shall carry out, directly or indirectly, a business with a sufficient level of operations and assets of sufficient value to support its operations to warrant the continued listing of the issuer’s securities.”

Where a listed issuer’s assets consist wholly or substantially of cash and/or short-term investments (i.e. securities that are held by the issuer for investment or trading purposes and are readily realisable or convertible into cash (including bonds, bills or notes which have less than a year to maturity and listed securities held for investment or trading purposes), it will not be considered suitable for listing and trading in its securities will be suspended (Main Board Listing Rule 14.82 and GEM Listing Rule 19.92). Cash and short-term investments held by a banking company, insurance company or a securities house will not normally be taken into account. However, the exemption for securities houses will not apply if the HKEx has concerns that the listed company is holding cash and short-term investments through a member to circumvent the rule on cash companies. For example, a listed company holding excessive cash and/or securities investments cannot circumvent the rule by holding such assets through a group member that is a licensed broker with minimal brokerage operations.

The difficulty in rescue situations is that in many cases the operations of the listed issuer have ceased to operate. The problems with a cash injection (which has never been classed as a notifiable transaction) stem from Listing Rule 13.24. Even where Listing Rule 13.24 is not a problem, there is the issue of the 36-month period during which any injection of new assets into the listed company will be aggregated with the restructuring transaction. If the aggregated transactions constitute a VSA, the issuer will be treated as a new listing applicant. For the investor, the question will be whether the business can be sustained for 36 months without any injection of assets.

9. Case Studies

The following cases extract some of the cases from Appendix to GL104-19.

9.1 Principle based test

Case 1: Acquisition considered to be reverse takeover

- Company A was principally engaged in hotel business. Its principal assets comprised one hotel property and cash. It had been loss making over the last five years.

- Company A proposed to acquire a majority interest in a target company that was newly established to carry out a natural gas project involving the construction and operation of gas pipes and gas stations in the PRC. The target company had signed relevant contracts for the natural gas project and expected to commence the sales of natural gas upon completion of the construction work for the project.

- The target company was expected to record substantial amounts of revenue and profits in the coming years. The proposed acquisition constituted a discloseable transaction for Company A based on the historical financials of the target company. However, based on the forecast financials of the target company, the acquisition was substantial with projected annual revenue at over 20 times of the revenue of Company A’s hotel business.

- The HKEx considered the proposed acquisition would constitute a reverse takeover because:

- Company A’s existing business had a low level of operations. Based on the target company’s business plan and financial forecast, its natural gas business would be significantly larger than the existing business of Company A in terms of revenue and profits.

- The target company’s natural gas business was different from, and unrelated to, Company A’s existing business. The proposed acquisition would lead to a fundamental change in Company A’s principal business.

- The target company had not generated any revenue before the proposed acquisition. It did not have a track record and could not meet the new listing requirements.

Case 2: Acquisition considered to be reverse takeover

- Company A was principally engaged in trading of food and beverage products.

- It proposed to acquire a target company that was engaged in the production and sale of organic fertilisers. The revenue, consideration and equity ratios of the proposed acquisition were between 110% and150%, and the asset ratio was about 90%.

- Company X (the vendor) was the target company’s sole supplier of a major raw material critical for production of the target company’s recognised products.

- Company X produced such raw material using its proprietary technology. Company X intended to recognise the target company to use such technology to produce the raw materials and expected the target company could master the technology and achieve full scale production of the raw material within three years.

- The HKEx considered the proposed acquisition would constitute a reverse takeover because:

- The target company’s business was different from, and unrelated to, Company A’s existing business. The proposed acquisition would lead to a fundamental change in Company A’s principal business given the significant size of the target company’s business.

- The proposal involved Company A acquiring part, and not the whole, of an integrated business from Company X. While the target company had planned to manufacture the raw material itself, it was uncertain as to whether and when the target company would be able to do so, and the impact of any such change in its business model and on its financial results. Thus, the target company’s historical track record could not reflect its performance after completion of the proposed acquisition.

- The target company was unsuitable for listing. It relied on Company X as the sole supplier of the critical raw material that had no alternative suppliers or substitutes for its products. The target company did not have the technology or expertise to produce the critical raw material independently. Company A could not demonstrate that the target company was, or would upon completion of the proposed acquisition be, capable of carrying on its business independently from Company X.

Cases 6, 7 and 8 Acquisitions of mining companies

- Each of Companies A, B and C proposed to acquire a target company which was engaged in mining activities.

- The size of the acquisitions was very significant to each of the Companies. When assessing whether the acquisitions would constitute reverse takeovers, one of the factors that the Exchange considered was whether the target companies could meet the new listing requirements for a mineral company.

- In these cases, there was an issue whether the target company could meet Rule 18.03(2) which requires a new applicant mineral company to have at least a portfolio of Indicated Resources, and the portfolio must be meaningful and of sufficient substance:

- In the case of Company A, the target company was engaged in oil and natural gas exploration, extraction and processing. It had exploration and extraction rights in two gas fields. One gas field was in a preliminary exploration stage and had resources classified as Prospective Resources under the Petroleum Resources Management System (PRMS). The target company had yet to commence any exploration work in the other gas field.

- In the case of Company B, the target company was engaged in the exploration, exploitation and processing of mineral resources in some offshore areas. It was agreed that:

- Company B would pay 10% of the consideration to the vendor upon completion of the acquisition on the basis that the vendor produced a valuation report showing that the offshore areas had Indicated Resources of value not less than 10% of the consideration.

- Company B would deliver to an escrow agent convertible securities representing the remaining 90% of the consideration. After completion of the acquisition, the vendor could perform extra works in the offshore areas during a specified period, and the escrow agent would release an amount of convertible securities to the vendor according to the value of any additional Indicated Resources discovered. After the specified period, Company B would cancel any convertible securities that had not been released to the vendor, and the consideration for the acquisition would be reduced accordingly.

- Company B submitted that it would only pay the consideration based on the value of the Indicated Resources identified under a reporting standard acceptable by the Listing Rules. The portfolio of mineral resources to be acquired was meaningful and of sufficient substance.

- In the case of Company C, the target company held mining rights of certain iron mines in the PRC but had not yet commenced production. To address the issue, Company C provided the estimate of resources and reserves for the iron mines identifiable under the Chinese standard. It would appoint a competent person to report on the resources and reserves under the JORC Code when preparing the circular for the acquisition at a later stage.

- In these cases, the Exchange considered that none of the target companies could meet the new listing requirements and thus the proposed acquisitions would constitute reverse takeovers:

- Company A failed to demonstrate that the target company had at least a portfolio of Contingent Resources as required under Rule 18.03(2).

- In the case of Company B, at the time of the proposed acquisition, the parties could only prove the existence of Indicated Resources of value representing 10% of the consideration, and a substantial part of the target company’s portfolio of minerals was not substantiated in the competent person’s report. The vendor was given a long period after completion of the acquisition to ascertain whether there were any additional Indicated Resources in the offshore areas. The circumstances of the case indicated that the target company was an early exploration company at the time of the acquisition and did not meet the requirements of Rule 18.03(2).

- Company C could only provide the estimate on resources and reserves under the Chinese standard when determining the transaction classification at the announcement stage. However, Chinese standards are not yet recognised as acceptable reporting standards for the purpose of the Chapter 18 requirements. As the basis for information presentation under Chinese standards and JORC-like codes are fundamentally different, resources and reserves presented under Chinese standards may not be recognised as such under JORC-like codes.

9.2 Bright Line Test

Case 11

- Company A operated port terminals in the PRC.

- Company X (controlling shareholder of Company A) was originally wholly owned by the Provincial Government. About a year ago, Company Y acquired a 51% equity interest in Company X from the Provincial Government. This constituted a change in control of Company A under the Takeovers Code.

- Company A proposed to merge with a target company which was listed on a PRC stock exchange and controlled by Company X. The target company also operated port terminals in the PRC.

- The proposed merger would constitute a reverse takeover under the bright line tests as it was a very substantial acquisition from Company X (being an associate of Company Y) within 36 months of Company Y gaining control of Company A through Company X. The profit ratio was about 120%. Other size tests were below 100%.

- The proposed merger would allow Company A to expand its existing port terminal business by integrating its port-related resources with those held by the target company and bringing synergy amongst the port operators controlled by Company X. Company A submitted that the proposed merger was not an attempt to achieve a listing of new business and sought a waiver from applying the bright line tests of Rule 14.06B to the merger.

- The HKEx agreed that the proposed merger was not a backdoor listing of new business by the incoming controlling shareholder and granted the waiver to Company A for the following reasons:

- The proposed merger was in line with Company A’s strategies to expand its port terminal business and the size of the merger was not significant to Company A. It would not result in a fundamental change to Company A’s principal business.

- The proposed merger represented an internal restructuring of the port-related businesses held under Company X which controlled Company A and the target company before the proposed merger and would continue to do so after the merger. There was no injection of assets or business from Company Y.

Case 12: Proposed change to the terms of restricted convertible securities previously issued by the issuer in connection with a very substantial acquisition

- About a year ago, Company A acquired a target company from the vendor. The target company’s principal business was different from that of Company A before the acquisition.

- The consideration was paid in (i) cash, (ii) consideration shares and (iii) restricted convertible notes. The convertible notes were redeemable only upon maturity three years after issue.

- The terms of the convertible notes included a conversion restriction which did not allow any conversion which would trigger a mandatory general offer under the Takeovers Code. The acquisition was classified as a very substantial acquisition based on percentage ratio calculations.

- Company A proposed an open offer, fully underwritten by the vendor, to raise funds for its business operations. If no shareholders took up their entitlements and the vendor took up all the offer shares, the vendor’s interest in Company A would increase from 18% to approximately 40%.

- Under the underwriting agreement, the vendor would fulfil its underwriting obligation partly in cash and partly by offsetting the convertible notes. To facilitate this offsetting arrangement, the parties proposed to change the terms of the convertible notes to make them redeemable before maturity. This would require the HKEx’s prior approval.

- At the time of the acquisition, the HKEx did not classify the acquisition as a reverse takeover given the terms of the acquisition and in particular, the conversion restriction was structured to avoid triggering the change in control test under the bright line tests of the RTO Rules.

- In considering whether to approve the proposed change in the redemption clause of the convertible notes, the HKEx was concerned that its purpose was to circumvent the RTO Rules because:

- The proposed change was to facilitate the offsetting arrangement which, together with the open offer, would allow Company A to redeem the convertible notes before its maturity and to issue new shares to the vendor resulting in the vendor taking control of Company A. This would effectively change the structure based on which the acquisition had not been treated as a reverse takeover.

- Company A had no other reason to immediately redeem the convertible notes which would mature in two years.

- In response to the HKEx’s concern, Company A and the vendor agreed to revise the open offer structure. There would be no change in the terms of the convertible notes and the vendor would not take control (as defined under the Takeovers Code) of Company A under the revised structure of the open offer.

10. Extreme Transactions

Case 15: Acquisition of a target company that met the new listing requirements

- Company A was principally engaged in leasing of properties, production and sale of education-related equipment and money lending. The leasing and education related equipment businesses contributed over 95% of Company A’s revenue in recent years.

- Company A proposed to acquire a target company from Company X (controlling shareholder of Company A for more than three years). The proposed acquisition would not result in a change in control of Company A.

- The target company was engaged in the provision of financial leasing and factoring services in the PRC. It was substantially larger than Company A, with percentage ratios between 10 and 35 times.

- The HKEx considered that the proposed acquisition would have the effect of achieving a listing of the target company’s business because:

- The size of proposed acquisition was extreme compared to Company A’s existing businesses and the target company’s business was different from Company A’s core businesses. Given the significant size of the proposed acquisition, it would result in a fundamental change in Company A’s principal business.

- Company A argued that the proposed acquisition was not an extreme case as it represented an expansion of Company A’s existing money lending business. However, the HKEx noted that the money lending business was small in scale. Further, the target company’s business was substantially different from Company A’s money lending business in terms of operating scale, business models and customers base. Company A would be substantially carrying on the target company’s business after the proposed acquisition.

- Nevertheless, the HKEx agreed that the proposed acquisition could be classified as an extreme transaction (and not a RTO) because:

- The target company could meet the new listing requirements (Rule 8.05(1)) and the suitability for listing requirement (Rule 8.04) subject to the completion of the financial adviser’s due diligenc work on the target company. The proposed acquisition was not an attempt to circumvent the new listing requirements; and

- Company A met the eligibility criterion set out in Rule 14.06C(1)(a) as it had been under control of Company X for more than 36 months and the proposed acquisition would not result in a change in control of Company A.

Case 16: Acquisition of a target company with a substantial change in its business model during the track record period constituted a reverse takeover

- Company A was principally engaged in trading business. It proposed to acquire a target company from Company X by issuing consideration shares. Upon completion of the acquisition, Company X would become a substantial shareholder of Company A (25% of the enlarged issued shares).

- The target company was significantly larger than Company A given the asset ratio of about 8 times and revenue ratio of about 50 times.

- The target company was principally engaged in coal mining. It owned two coal mines (Target Mines) which had been under commercial production for a few years. The information provided showed that there were changes in the business model of the target company:

- During the track record period, the target company had been selling mixed coal by mixing the coal extracted from the Target Mines with different types of raw coal purchased from other coal mines owned by Company X (Other Mines).

- The target company’s coal products were mainly sold to Company X who then on-sell the products to customers for the purpose of centralised management and planning by Company X. Sales to Company X accounted for about 50% of the target company’s revenue in the first year of the track record period, and over 90% in the last two financial years.

- In light of the recent change in market conditions, the target company intended to sell coal produced from the Target Mines without mixing with raw coal from the Other Mines after completion of the proposed acquisition.

- Further, the target company had set up its own sales and distribution team and started to sell its products directly to the customers.

- Company A submitted that the target company could meet the profit requirement for new listing applicants under Rule 8.05(1) and the acquisition should be treated as an extreme transaction.

- The HKEx considered that the proposed acquisition would constitute a reverse takeover because:

- Company A’s existing business had a small scale of operations and the target company was significantly larger than Company A.

- The proposed acquisition would result in a fundamental change in Company A’s business.

- Although Company A submitted that the target company would meet the profit requirement under Rule 8.05, the HKEx was concerned that the target company’s historical financial information were not representative of its future performance due to the significant changes in its business model, including the type of coal sold and the sales and distribution arrangements. As these changes only took place recently, the target company’s trading record could not provide sufficient information to allow investors to make an informed assessment of the management’s ability to manage the target company’s business and the likely performance of that business in the future. The HKEx was concerned that the target company could not satisfy the new listing requirements under Paragraph 2 of Practice Note 3.

This note is provided for information purposes only and does not constitute legal advice. Nor does it create a client-law firm relationship between any reader of this note and Charltons. Specific advice should be sought in relation to any particular situation. This note has been prepared based on the laws and regulations in force at the date of this note which may be subsequently amended, modified, re-enacted, restated or replaced. We are under no obligation to update its contents in that event.

[1] HKEx Guidance Letter 104-19. “Guidance on Application of the Reverse Takeover Rules”, last updated in September 2024. Available at 11.1 of the HKEx Guidance Materials for Listed Issuers at https://www.hkex.com.hk/-/media/HKEX-Market/Listing/Rules-and-Guidance/Interpretation-and-Guidance/Guidance-Materials-for-Listed-Issuers/GM_consolidated.pdf

[2] Main Board Listing Rule 13.52(2)(a)/ GEM Listing Rule 17.52(2)(a)

[3] GL104-19 at paragraph 57